Why we only accept “fresh” claims

Why you need a Public Adjuster immediately after a fire loss

Do you want a generalist or a specialist as your Public Adjuster?

How we settled a $1.7M claim in just 34 days.

How We Increased Their Settlement From $9,456 to $475,235.

Why we specialize in residential fire claims

Should you hire a Public Adjuster?

Why your claim will get underpaid without a Public Adjuster (and what you can do about it).

Your insurance company doesn’t want you to see this.

The 3-options after experiencing fire damage

Licensed Public Adjusters serving New York, New Jersey, Connecticut, and more.

Should I Hire a Public Adjuster?

Have you recently sustained property damage?

Are you overwhelmed with the shock, stress, and confusion of experiencing sudden property damage?

Do you feel frustrated with the overwhelming amount of time, effort, and specialized knowledge it takes to go through the insurance claims process?

If you’ve suffered damage to your property, whether it’s your home or your business, you may be wondering whether you should hire a public adjuster to help you navigate the insurance claims process. A public adjuster is a professional who is licensed and trained to assist policyholders in filing insurance claims, negotiating with insurance companies, and ensuring that they receive the maximum possible settlement for their losses.

When it comes to the claims process, you have to consider the following:

- Filing the claim

- Finding temporary living arrangements

- Emergency Mitigation

- Remediation of hazardous materials like mold, asbestos, and lead

- Calls and emails with adjusters

- Scheduling meetings

- Estimating building damages

- Inventorying contents items

- The list goes on…

Not only do you have to review the above, but you have to go through all of these tasks in the right order so you can expedite your recovery, avoid mistakes, maximize your settlement, and get back to your normal life– all without jeopardizing your claim.

Of course, your insurance company and those they hire may insist that they are there to help you. And while they do have their adjusters, contractors, engineers, and every other person at their beck and call, what they don’t tell you is that those folks are there to help your insurance company– not you!

In other words, they are there to minimize the amount of money that the insurance company has to pay you. This can result in claims processes lasting weeks, months, even YEARS, for some folks– that’s simply unacceptable.

It’s important to understand that insurance companies are businesses. Their primary goal is to maximize profits. This means that when you file a claim, the insurance company’s adjuster is going to be looking for ways to minimize the amount they have to pay out. While insurance adjusters are trained to be friendly and helpful, they are not working for you; their loyalty lies with their employer.

You know you need someone you can trust.

An expert who can advise you through the claims process.

Someone with a team who is familiar with all aspects of the claims process, helping you to avoid the pitfalls and receive the maximum benefits available under your policy.

Benefits of Hiring A Public Adjuster

You already have enough on your plate after suffering property damage to your home or business.

You know about your policy and the repair costs, but how do you manage everything so as to expedite your recovery, and receive the maximum claim settlement?

This is where a Public Adjuster can help.

A Public Adjuster works exclusively for the policyholder– that’s YOU. Our job is to make sure you receive the maximum possible settlement for your losses. We will conduct a thorough inspection of your property, document all damages, and negotiate with the insurance company on your behalf. We have a deep understanding of insurance policies and claim procedures, and can often identify damages and expenses that you may not have considered.

One common misconception about Public Adjusters is that they are expensive. While it’s true that Public Adjusters charge a fee for their services, the fee is typically a percentage of the settlement amount– and it’s only charged if you receive a settlement. This means that if you don’t receive a settlement, you don’t owe anything to the Public Adjuster.

Additionally, many policyholders find that the increased settlement they receive with the help of a Public Adjuster more than covers the cost of their services.

How to Choose a Public Adjuster

When considering a Public Adjuster, there are a few factors to consider. You’ll want to look for a Public Adjuster who is licensed and experienced in handling claims similar to yours. You can check their qualifications and credentials with the American Association of Public Insurance Adjusters or your state’s insurance department. Ask for references from previous clients and check their reviews online. Any good public adjuster should be responsive to your questions and concerns and keep you updated on the progress of your claim.

A good Public Adjuster will also be transparent about their fees and provide a clear explanation of how they will handle your claim. Finally, make sure the Public Adjuster you choose is available to work on your claim when you need them.

So, Who Are We?

My name is McKinley McNair, and I’m the Founder and President of Manhattan Public Adjustment.

As a Public Adjuster firm, we operate as a team of licensed insurance professionals who work for policyholders– not their insurance companies. Our area of expertise includes helping those who’ve suffered major fire and water damages to their homes.

Not only are we certified in fire restoration and water restoration by the IICRC, we’re also members of the American Association of Public Insurance Adjusters. And we’ve helped hundreds of people just like you.

Our Success Stories

Just the other day, I was celebrating a successful claim with our Director of Claims, Jennifer Kosiba. We had helped this particular client to settle for over $475,200 in a water damage claim. Their insurance company had offered them just over $10,000. Yep, you read that right.

We helped this client achieve an increase of nearly 47x, turning a lowball offer into the coverage they actually deserved. In fact, after helping hundreds of people to successfully navigate the insurance claims process, we’ve found this common trend:

There’s just too much to do and you don’t have the time or expertise to manage everything yourself!

There really comes a time when you have to say to yourself, enough is enough.

You need to find a team who knows what they’re doing; a successful team to guide you in the right direction. A team that will prioritize and handle ALL claim-related tasks for YOU.

The good news is that you’re reading this.

Our mission is to help people like you receive the maximum benefits available under their policy. How do we achieve that mission? We use a system called The Manhattan Method™.

The Manhattan Method™

At Manhattan Public Adjustment we use The Manhattan Method™, our proven three-pillar claim handling strategy which is outlined below.

- Manhattan Claim Concierge: This is the first pillar in which our clients work 1-on-1 with our Executive Public Adjuster and Director of Claims Operations, their primary point of contact throughout the claims process. In the claim concierge service, we manage everything related to the claim including communication, inspections, estimation, negotiation, settlement, and any other claim-related matters that may pop up.

- Estimating Partnership: The second pillar is our Exclusive Estimating Partnership with Empire Estimators, which allows us to provide you with the fastest and most comprehensive property damage estimating services for your loss. This ensures you get paid what you need to restore your property to its pre-loss condition.

- Company DNA and Collaboration: The third and final pillar is all about our team who knows how insurance companies think and operate. We have infused that knowledge into how we handle claims at Manhattan Public Adjustment. Our firm is organized in such a fashion that we have the ability to collaborate on each and every claim, developing and executing a unique claim-handling strategy tailored to our client’s specific needs.

Ultimately, when you choose to work with Manhattan Public Adjustment, you get the peace of mind that comes from having a trusted claims partner who will lead you through the claims process, expedite your recovery, and help you receive the maximum benefits available under your policy — with ease.

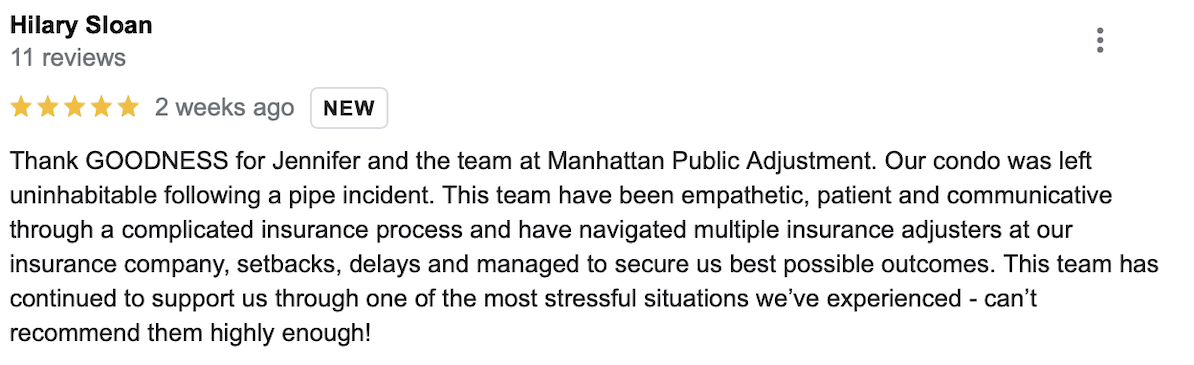

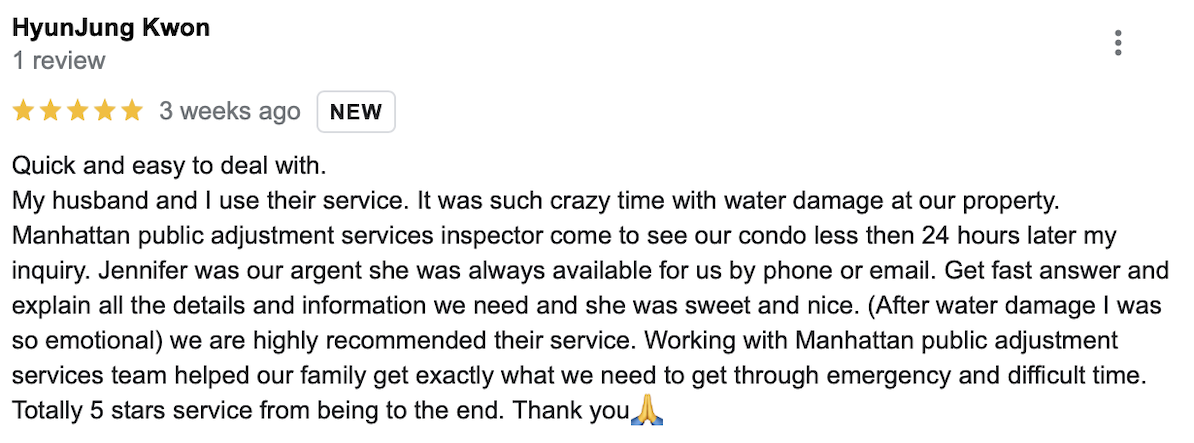

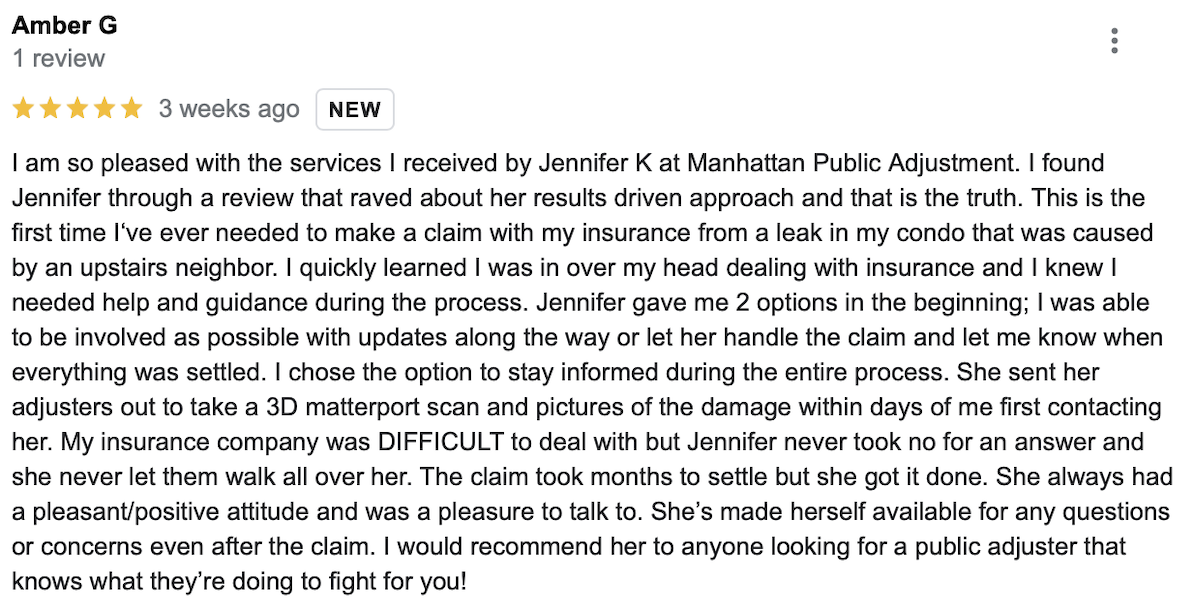

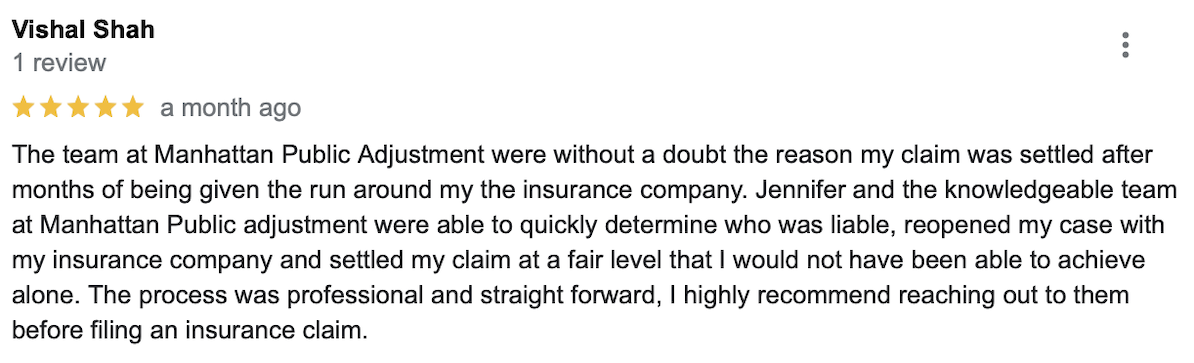

What clients are saying

Your 3 Options

Right now, if you have major property damage and you’re reading this, you realistically have three options.

OPTION #1 – GO IT ALONE

In this case, you are trusting your insurance company to lead you through the claims process. Depending on the complexity of your claim, this could be an option. If your claim is straightforward, and the damages are easily documented and quantified, you may be able to handle the claim on your own. However, you really need to consider the damages and intricacies of your claim.

And, remember, while your insurance company may assure you initially, when it’s time to pay, it’s their business to minimize payouts. By choosing this option, you may waste valuable time and it’s with almost absolute certainty that you won’t receive the maximum benefits you’re entitled to under your policy.

OPTION #2 – HIRE A PUBLIC ADJUSTER WHO IS A CLAIMS GENERALIST

A Public Adjuster who is a claims generalist is one who handles all types of claims, similar to a doctor who is a “general practitioner.” While a generalist can be great for smaller claims, it’s not recommended to use this type of Public Adjuster for major claims.

Sure, they may know a little bit about every type of claim, but each claim type is extremely different. What works for theft claims doesn’t work for fire damage claims.

Further, generalists often work alone; they don’t have a team of experts backing them who can help to expedite your claim. They are answering the phone, negotiating claims, prepping inventories, writing estimates…

They are typically stretched too thin to effectively handle a major loss that truly requires a team effort. And while they may tout their “experience” because they’ve been in the business for a long time, they likely use outdated and ineffective claim-handling methods that, quite frankly, just don’t work today.

A generalist simply doesn’t have time to dedicate to major property damage claims, which ultimately leads to poor customer support, poor follow-up, and slow claims handling. This means a longer claims process for you and, likely, smaller settlements overall.

While hiring a Public Adjuster who is a claims generalist is likely better than going it alone, it is NOT the best choice when you have major property damage.

OPTION #3 – RETAIN A PUBLIC ADJUSTER FIRM THAT SPECIALIZES IN YOUR TYPE OF CLAIM

Your third and best option, in this case, is to retain a Public Adjuster firm. Specifically, a firm that specializes in your type of property damage claim.

The firm should have a proven strategy, a streamlined process, a proven track record of helping property owners with claims like yours.

They would also have a team consisting of Public Adjusters, Estimators, and other experts who specialize in helping people in your situation achieve maximum property claim outcomes.

As specialists, everyone on their team would have a great depth of knowledge, a dedication to customer service, and an ability to achieve results for residential fire/water damage claims that generalists simply can’t match.

With a specialist, you’ll have peace of mind knowing your claim is being handled using a proven team and process that you can trust.

And that’s what we do at Manhattan Public Adjustment.

We specialize in handling major residential fire and water damage claims.

And we can help you.

We want to help you.

We’re here to help you.

We’re here to use our proven Manhattan Method to help you receive the maximum settlement, expedite your recovery, and successfully navigate the insurance claims process with ease.

Simply put, if you have suffered a major residential loss –

We can help.

Speak with us

If you’ve suffered major fire or water damage to your home, click the button below to schedule your free claim consultation with one of our Public Adjusters. On your claim consultation, we’ll discuss your damages, your claim goals, and how we can help you achieve them.

We’ll answer any questions on your call.